We Lead and Advise Global CEO-CxO Teams

Saving Global CEO-CxO Teams 90% Time & Cost

Building Agile and Resilient Enterprises, Systems, Technologies

We Enable Global Digital CEO-CxO Teams by "accelerating business technology performance" and "engineering risk resilience" in Knowing-Building-Monetizing™ Hi-Tech Digital Practices, Strategies, Technologies, Architectures, Teams, Networks, and Ventures.

From Future of Finance™ to Future of Defense™

Because the Future of the World Depends Upon It™

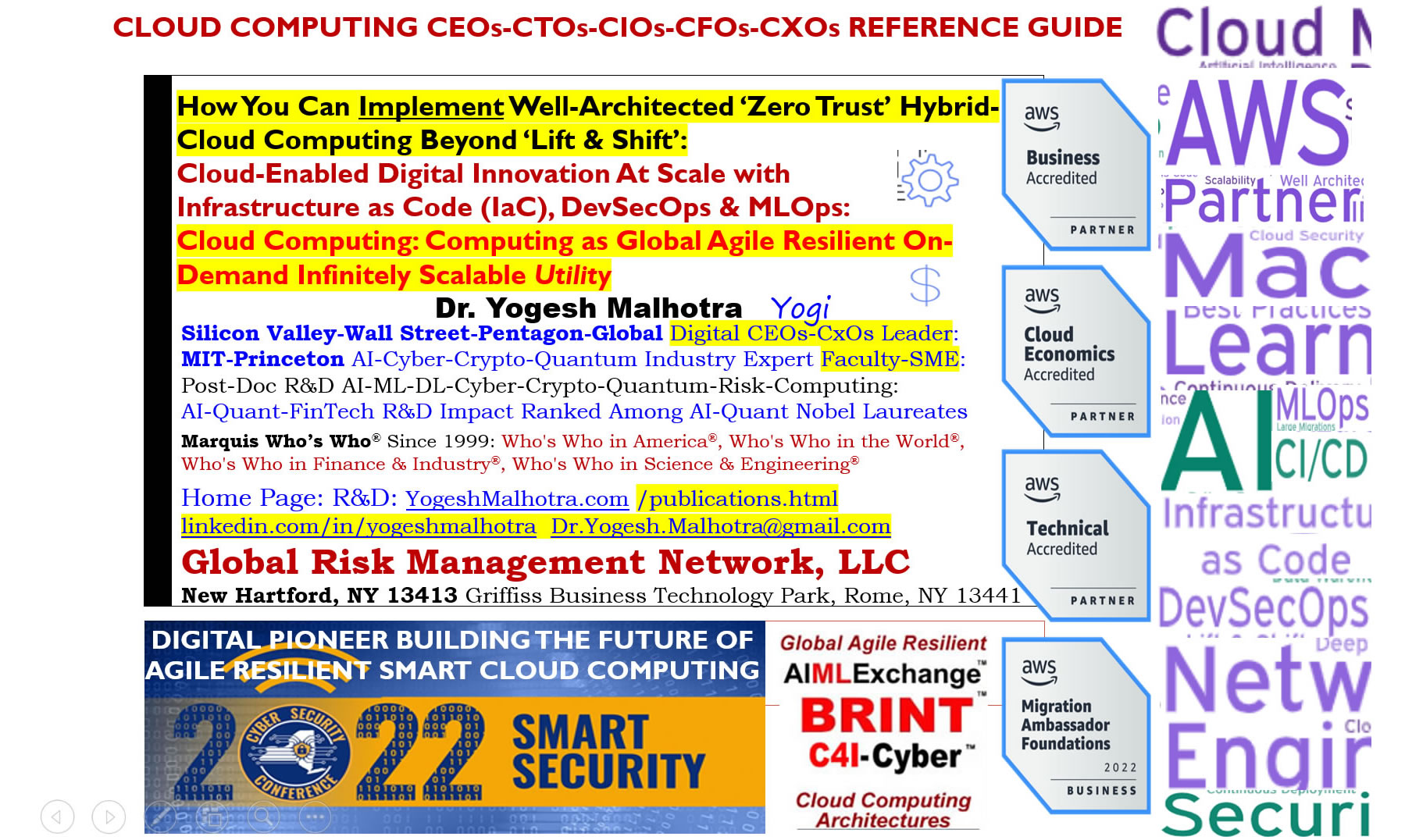

Our current Hi-Tech focus spans Artificial Intelligence (AI), Machine Learning (ML), Deep Learning (DL), Natural Language Processing (NLP), Robotic Process Automation (RPA), Data Science & Advanced Analytics, FinTech-Crypto, Computational Quantitative Finance & Trading, Blockchain and Cloud Computing, Cybersecurity & Cryptography, Penetration Testing & Ethical Hacking, Model Risk Management & Model Risk Arbitrage, Quantum Computing & Quantum Cryptography, Quantum Uncertainty & Time Space Complexity among other technology themes.

“The new business model of the Information Age, however, is marked by fundamental, not incremental, change. Businesses can't plan long-term; instead, they must shift to a more flexible anticipation-of-surprise model.”

- CIO Magazine Interview, Dr. Yogesh Malhotra.

“The very essence of what various IT systems can do in the context of KM begins and ends with people and processes. In absence of motivation and commitment on the part of the users, such systems cannot function.”

- CIO Insight Interview, Dr. Yogesh Malhotra.

“Obsolete what you know before others obsolete it and profit by creating the challenges and opportunities others haven't even thought about...”

- Inc. Magazine Interview, Dr. Yogesh Malhotra.

“Yogesh Malhotra says his vision is to fill the gaps between business and technology, data and knowledge, and, theory and practice...”

- Fortune Magazine Interview, Dr. Yogesh Malhotra.

“Knowledge Management refers to the critical issues of organizational adaptation, survival and competence against discontinuous environmental change. Essentially it embodies organizational processes that seek synergistic combination of data and information processing capacity of information technologies, and the creative and innovative capacity of human beings.”

- The Wall Street Journal Interview, Dr. Yogesh Malhotra.

“The synergy of 'smart minds' and 'smart technologies' provides a basis for defining agile and adaptable supply chain networks that can withstand the challenges of a radically changing business environment.”

- Institute for Supply Management Interview, Dr. Yogesh Malhotra.

Join Our Social Media Network on LinkedIn!

'Your Survival Network for The Brave New World Of Business'™

“The best way to predict the future is to create it.” —Peter Drucker

We Create the Digital Future™

We have been Doing So Since the Beginning of the WWW...

AWS-Quantum Valley: Building the Future of AI-Quantum Networks Beyond ChatGPT-GenAI-LLMs™

We have been Doing So Since the Beginning of the WWW...

Worldwide top leadership programs such as the Harvard MBA, world leaders such as Microsoft founder Bill Gates, Big-4 CxOs, and, CIOs of the US Army, US Navy, and US Air Force, and, the U.S. Joint Chiefs of Staff of the Department of Defense including U.S. National Heads of C4 Systems and National Defense University have adopted, applied, and recommended our digital ventures transforming global digital practices.

Sample of our corporate and organizational clients and patrons

Banking-Finance-IT: Goldman Sachs, Google, HP, IBM, Intel, Microsoft, Wells Fargo

Consulting Firms: Accenture, Ernst & Young, McKinsey, Pricewaterhouse Coopers

Healthcare: WHO, US Health & Human Services, UK Dept. of Health, European HMA

World Governments: Australia, Brazil, Canada, China, European Union, UK, USA

U.S. Defense: AFRL, Air Force, Army, CCRP, Comptroller, DISA, DoD, NASA, Navy

World Defense: Australia (Air Force), Canada (Defence R&D), UK (Ministry of Defence)

Universities: Harvard, INSEAD, MIT, Princeton, Stanford, UC Berkeley, Wharton

Associations: AACSB, ABA, ACM, AICPA, AOM, APICS, ASTD, ISACA, IEEE, INFORMS

Global Business & IT Editorial Reviews as Industry Benchmark

Wall Street Journal, New York Times, Fortune, Fast Company, Forbes, Business Week, CIO, CIO Insight, Computerworld, Information Week, etc.

Global Risk Management Network, LLC

New York, USA

World-Leading R&D Building, Leading & Growing World-Leading

Global Digital Practices, Technologies, Teams, and, Ventures

We create the Digital Future™ Since the Beginning of the WWW.

Global Digital Practices, Technologies, Teams, and, Ventures

EMAIL CONTACT: Dr.Yogesh.Malhotra at gmail.com

Biographical Profile LinkedIn Profile Amazon.com Author Profile

Download Our Research:

Industry Expert Papers, Conference Keynotes & Presentations

and Published Books, Journals & Papers

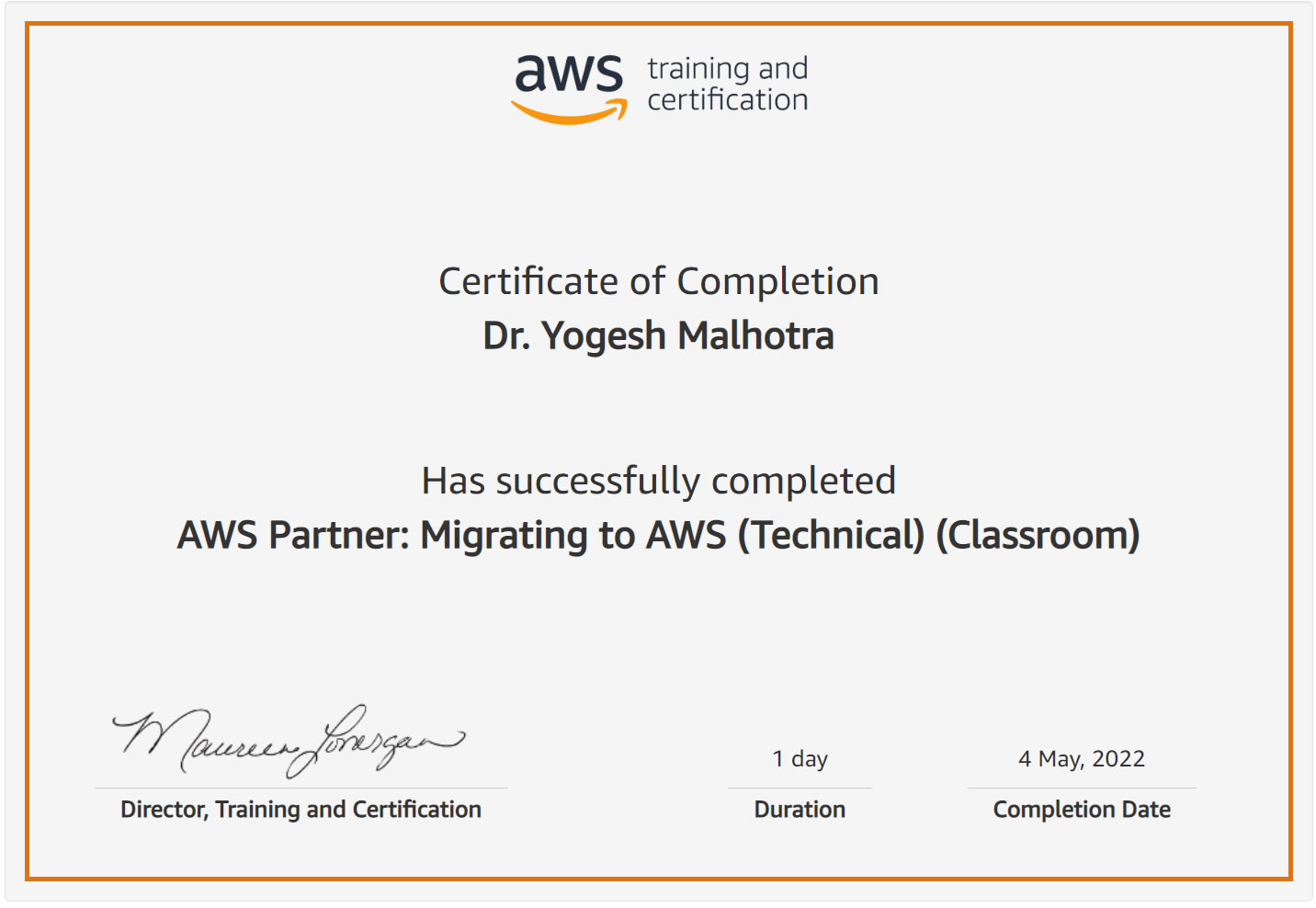

AWS Network Cloud Computing Partner Executing the Post-AI-Quantum Future of Smart Cloud Computing

Silicon Valley-Wall Street-Pentagon Digital Pioneer: MIT-Princeton Expert: R&D Impact Among Nobel Laureates

Invited Interviews: Top U.S. Air Force Science Role, Pentagon United States Air Force Chief Scientist

GIBC Digital Welcomes Leading Machine Learning & AI Expert to Head $1 Billion AI-ML Excellence Center

Block Chain Cloud Pioneer welcomes Dr. Yogesh Malhotra as Chief AI-Crypto Strategy-Technology Architect

AACSB Impact of Research Report: Dr. Yogesh Malhotra's R&D among Finance Nobel Laureates: Black-Scholes

Business Standard: Dr. Yogesh Malhotra Among Digital Pioneer Professors from Dartmouth, Harvard & Yale

![AWS Network Partner: Dr. Yogesh Malhotra: Global Risk Management Network, LLC: We Create the Digital Future [TM]](https://yogeshmalhotra.com/images/AWSPartnerNetwork.jpg)